Introduction: The importance of securing a personal loan with low interest rates

Securing a personal loan can feel like navigating a maze. With so many options available, the quest for low interest rates can be daunting. Yet, finding that perfect loan not only eases financial burdens but also saves you money in the long run. Imagine having more cash in your pocket while pursuing your dreams or handling unexpected expenses without breaking the bank. By following some key tips, you can unlock better rates and favorable terms that align with your financial goals. Let’s dive into how to make this journey smoother and more rewarding!

Step 1: Understand your credit score and financial situation

Your credit score is a crucial factor in determining the interest rates you’ll be offered on a personal loan. Before diving into applications, take time to check your score. This number reflects your creditworthiness and can influence lenders’ decisions significantly.

Understanding your financial situation goes hand in hand with this. Gather details about your income, debts, and expenses. This information will help you gauge how much you can realistically borrow without overextending yourself.

Be aware of what constitutes a good credit score in today’s market. Generally, scores above 700 are considered favorable for obtaining low-interest loans. If yours falls short, identify any issues that might be dragging it down.

This knowledge empowers you as you navigate the lending landscape. You’ll not only feel more prepared but also discover better options tailored to your specific circumstances.

Step 2: Shop around for the best loan options

When it comes to securing a personal loan with low interest rates, shopping around is essential. Different lenders offer varying terms and conditions, so exploring your options can lead to significant savings.

Start by comparing traditional banks, credit unions, and online lenders. Each has its strengths. Credit unions often provide lower rates for their members, while online platforms might have more flexible requirements.

Don’t just look at the interest rate; consider other fees too. Origination fees or prepayment penalties can affect the overall cost of your loan.

Utilize comparison websites to streamline this process. They can quickly highlight differences in offers from multiple lenders side by side.

Reach out directly to potential lenders for personalized quotes. Sometimes negotiating could result in better terms than those advertised online. Remember, informed decisions pave the way for financial success.

Step 3: Improve your credit score before applying for a loan

Improving your credit score can be a game-changer when securing a personal loan with low interest rates. Lenders look at this number closely, as it reflects your borrowing history and reliability.

Start by checking your credit report for errors. Disputing inaccuracies can give an immediate boost to your score.

Next, focus on paying down outstanding debts. Reducing balances on credit cards shows lenders that you’re responsible with money.

Timely payments are crucial too. A consistent track record of paying bills on time establishes trustworthiness in the eyes of potential lenders.

Consider diversifying your credit mix if possible, such as adding an installment loan or reducing the amount owed on revolving accounts.

Every little step counts toward enhancing that all-important score before you fill out any loan applications.

Step 4: Consider secured vs unsecured loans

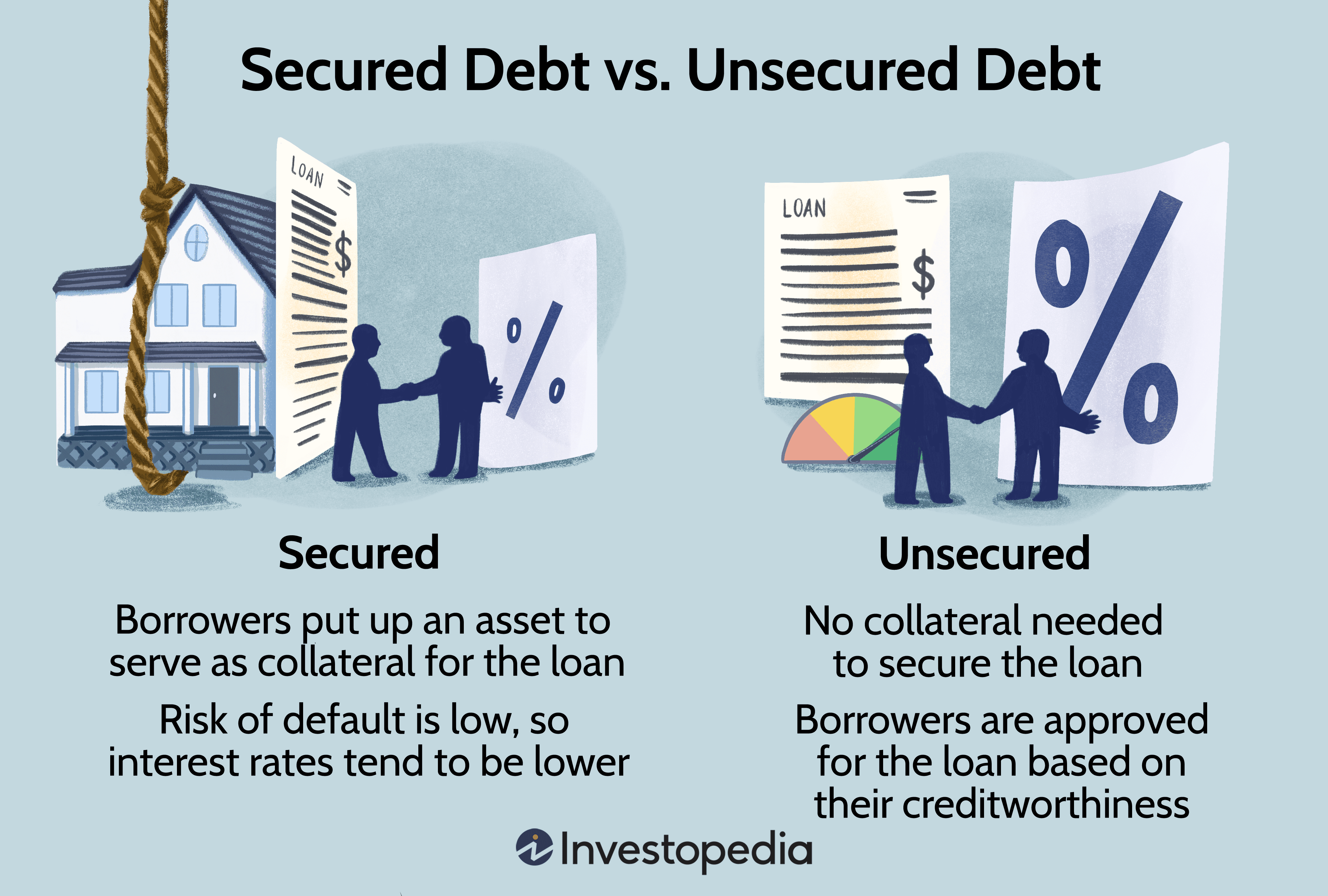

When considering a personal loan, it’s essential to weigh the differences between secured and unsecured loans. Secured loans require collateral, such as your home or car, which can lower the interest rate. This is because lenders have an asset they can claim if you default.

On the flip side, unsecured loans don’t demand any collateral but tend to come with higher interest rates. They rely heavily on your creditworthiness. If you have a strong credit score, this option might be more appealing despite the potential for increased costs.

Before deciding, think about what you’re comfortable risking. If you’re confident in your ability to repay and want lower rates, secured could be worth the risk. But if you prefer to keep your assets safe from potential loss during repayment difficulties, an unsecured loan might be a better fit for your needs and peace of mind.

Step 5: Negotiate with lenders for lower interest rates

Negotiating with lenders can feel intimidating, but it’s a crucial step in securing a personal loan with low interest rates. Start by doing your homework. Understand the current market rates and have data ready to back up your request.

When you approach lenders, be confident but polite. Express your appreciation for their services while stating that you’re exploring options to find the best deal possible.

Don’t hesitate to mention offers from competing institutions. A better rate elsewhere can often prompt lenders to reconsider their terms.

If you have an existing relationship with a bank or credit union, leverage that connection too. Loyalty may reward you with lower rates simply because they want to keep your business.

Remember, negotiation is part of the process—lenders expect it! Be prepared for some back-and-forth discussions as this could ultimately save you significant money over time.

Conclusion: Don’t settle for high interest rates, follow these

Securing a personal loan with low interest rates can significantly impact your financial health. It’s essential to take proactive steps to ensure you get the best deal possible. Understanding your credit score and financial situation lays a solid foundation for your search. Shopping around gives you insights into various lenders, helping you find competitive options.

Improving your credit score is also crucial; small changes can lead to better offers. Weighing the pros and cons of secured versus unsecured loans will help you make informed decisions that suit your needs. Don’t hesitate to negotiate with lenders—there’s often room for discussion.

Don’t settle for high interest rates if you don’t have to! By following these tips, you’re positioning yourself for success in finding the right personal loan at an affordable rate that suits your financial goals. Your efforts in research and negotiation could save you significant money over time, making this journey well worth it.